What is an unsecured loan? Can businesses get unsecured loans?

Unsecured loans - What Are They?

Unsecured loans are a flexible and convenient financial service that is increasingly becoming a popular choice for individuals in their lives. This is a form of lending that doesn't require collateral but relies entirely on an individual's creditworthiness regarding their ability to repay, serving personal consumption purposes. It could be a loan for lifestyle needs like organizing a wedding, traveling, or purchasing consumer goods such as TVs, air conditioners, or phones.

The process of unsecured lending is usually carried out through financial institutions. These institutions provide specific loan amounts to users with flexible terms and conditions in the contract, competitive interest rates, and clear repayment periods. This makes unsecured loans a preferred choice for those in need of quick and convenient capital.

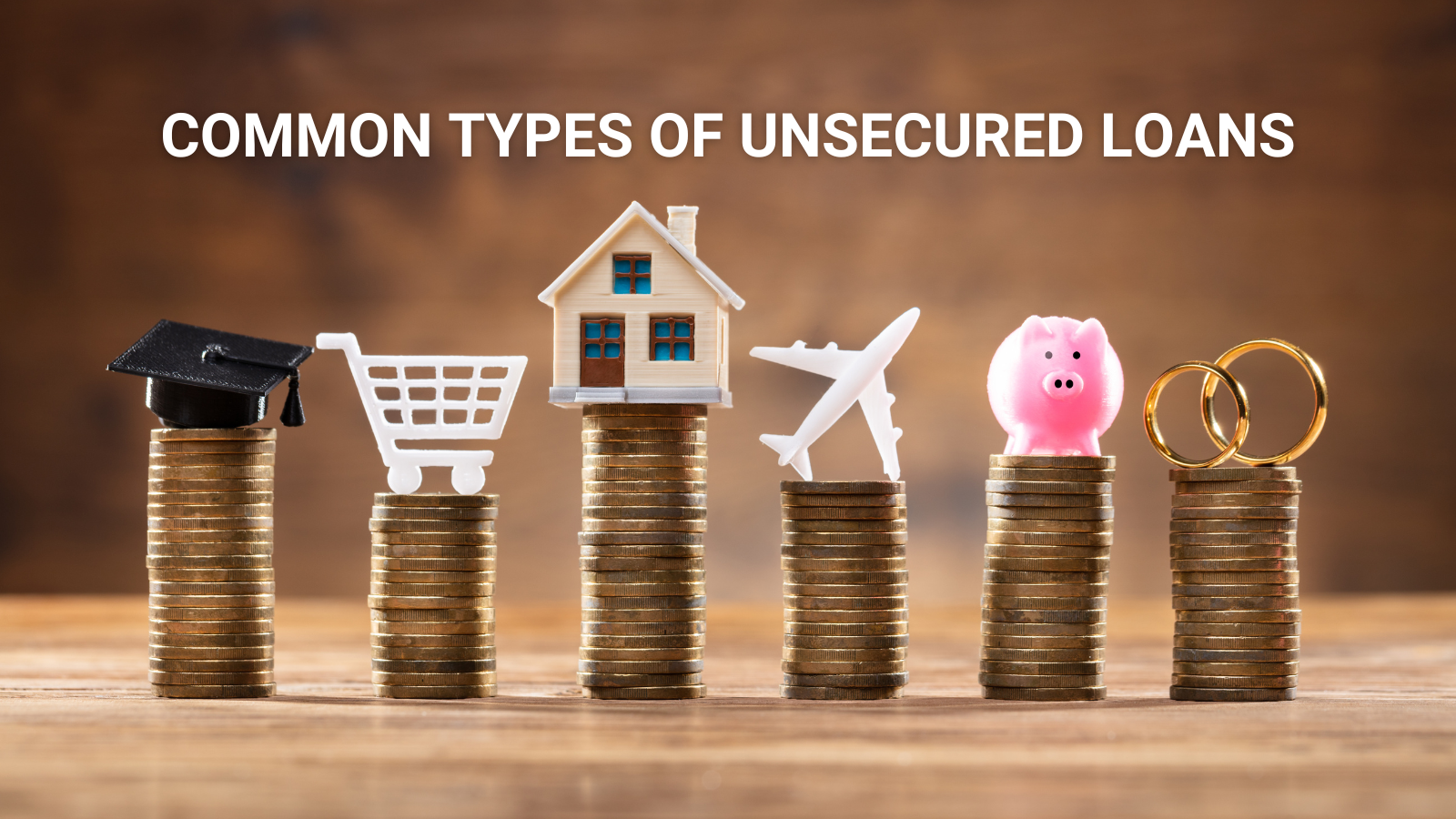

Common types of unsecured loans

Based on the needs and individual conditions of borrowers, financial institutions offer various types of unsecured loans. Here are some common types:

- Personal Loans: Used for personal expenses, shopping, travel, or paying personal debts.

- Home Improvement Loans: Upgrading, enhancing homes, or purchasing furniture.

- Education Loans: Tuition fees, books, laptops, etc.

- Wedding Loans: Costs related to organizing weddings, wedding parties, attire, services, etc.

- Small Business Unsecured Loans: Providing capital for small and medium businesses, bill payments, business expansions, etc.

- Secured-Unsecured Loans Combination: Loans secured against assets like real estate, cars, for lower interest rates.

- Loans for Salaried Individuals: Allowing employees with monthly income to borrow for personal expenses.

Each type of unsecured loan has its strengths and weaknesses. Choosing the appropriate type depends on your capital utilization purposes and your repayment capabilities.

Applying for Unsecured Loans - Simple Procedures, Quick Results

Customers only need to fill out an online unsecured loan application or apply directly at the branches of financial institutions. Throughout the process and documentation, you will receive guidance from staff. The simple procedures help save time, enabling you to acquire capital quickly.

Applying for Unsecured Loans - Simple Procedures, Quick Results

Customers only need to fill out an online unsecured loan application or apply directly at the branches of financial institutions. Throughout the process and documentation, you will receive guidance from staff. The simple procedures help save time, enabling you to acquire capital quickly.

Where to Apply for Unsecured Loans?

- Banks:

- Pros: High credibility, reliability, various loan products, competitive interest rates.

- Cons: Complex application procedures, high income and asset criteria.

Financial Companies:

- Pros: Simple procedures, competitive interest rates, flexible services.

- Cons: Interest rates might be higher than banks.

When choosing a financial company, placing trust in a professional and humane organization is crucial. You may consider exploring loan packages at Shinhan Finance, an institution recognized by the National Credit Information Center (CIC) as an exemplary unit in credit information activities in 2022.

Unsecured loans for small businesses and notices when borrowing?

Getting unsecured loans for small businesses depends on several factors:

- Lender requirements:

- Some banks or lending institutions have programs specifically for businesses.

- Requirements could relate to monthly revenue, business history, or the individual credit profile of the business owner.

Nature of the business:

- Different definitions exist for businesses (could be sole proprietors, small shops, small and medium enterprises).

- The nature and scale of the business can impact the ability to secure unsecured loans.

Financial essentials and documentation:

- Clear financial records, stable income, and good business history can enhance loan eligibility.

- Some lenders may require evidence of profits or cash flow to prove repayment capability.

Purpose of capital usage:

- Depending on the capital utilization, some lenders offer specific unsecured loan products for small businesses.

Advice:

- Understand conditions and requirements: It's crucial to understand the terms and conditions of banks or lenders before applying.

- Prepare clear financial records: Ensure your small business's financial records are well-prepared to demonstrate repayment ability and business prospects.

Conclusion

With the information provided, you now have a clearer understanding of what unsecured loans are and whether they can be availed of for businesses. Don't hesitate to apply promptly to access flexible and fast capital to meet your financial needs. Learn more about unsecured loans and apply now to experience the convenience and flexibility in fulfilling your financial requirements at Shinhan Finance !

-----------------------

The fastest channels to register for a loan:

- Hotline: 1900 54 54 49 (press 2 – Loan consultation)

- Website Shinhan Finance

- iShinhan financial management application

- Fanpage Shinhan Finance

- Directly at Shinhan Finance transaction counters: See the address details of Shinhan Finance branches.

Sincerely,

Shinhan Finance