SHOULD YOU CHOOSE ONLINE CONSUMER LOANS AT SHINHAN FINANCE?

According to Google statistics, "consumer loans, personal loans, online loans..." are among the keywords that many customers are interested in when they need to borrow money. So, what exactly are consumer loans, and can you get consumer loans online? Let's find out in the article below from Shinhan Finance!

What are consumer loans?

Consumer loans are a type of loan provided by banks or financial institutions to individuals in need of financial support for personal expenses. These loans can be used for personal purposes and are typically unrelated to business activities or investments. They can serve various personal needs such as purchasing electronic devices, furniture, travel, tuition fees, medical expenses, or any other personal needs. Consumer loans usually do not require collateral and offer flexible repayment terms, although the interest rates may be higher compared to loans secured with assets. Currently, electronics stores, motorcycle dealerships, or shopping centers are all supporting customers in purchasing through consumer loans.

Characteristics of consumer loans

- Minimum interest rate from 18% per year, calculated on a reducing balance basis (Terms and Conditions apply)

- Loan amount up to 12 times monthly income and a maximum of 300 million VND, for personal purposes to serve daily life

- Loan terms range from a minimum of 12 months to a maximum of 48 months.

- Disbursement within 48 hours after approval.

For example: With a credit loan of 60 million VND, a loan term of 12 months, and an 18% interest rate, you only need to pay 5,500,800 VND per month.

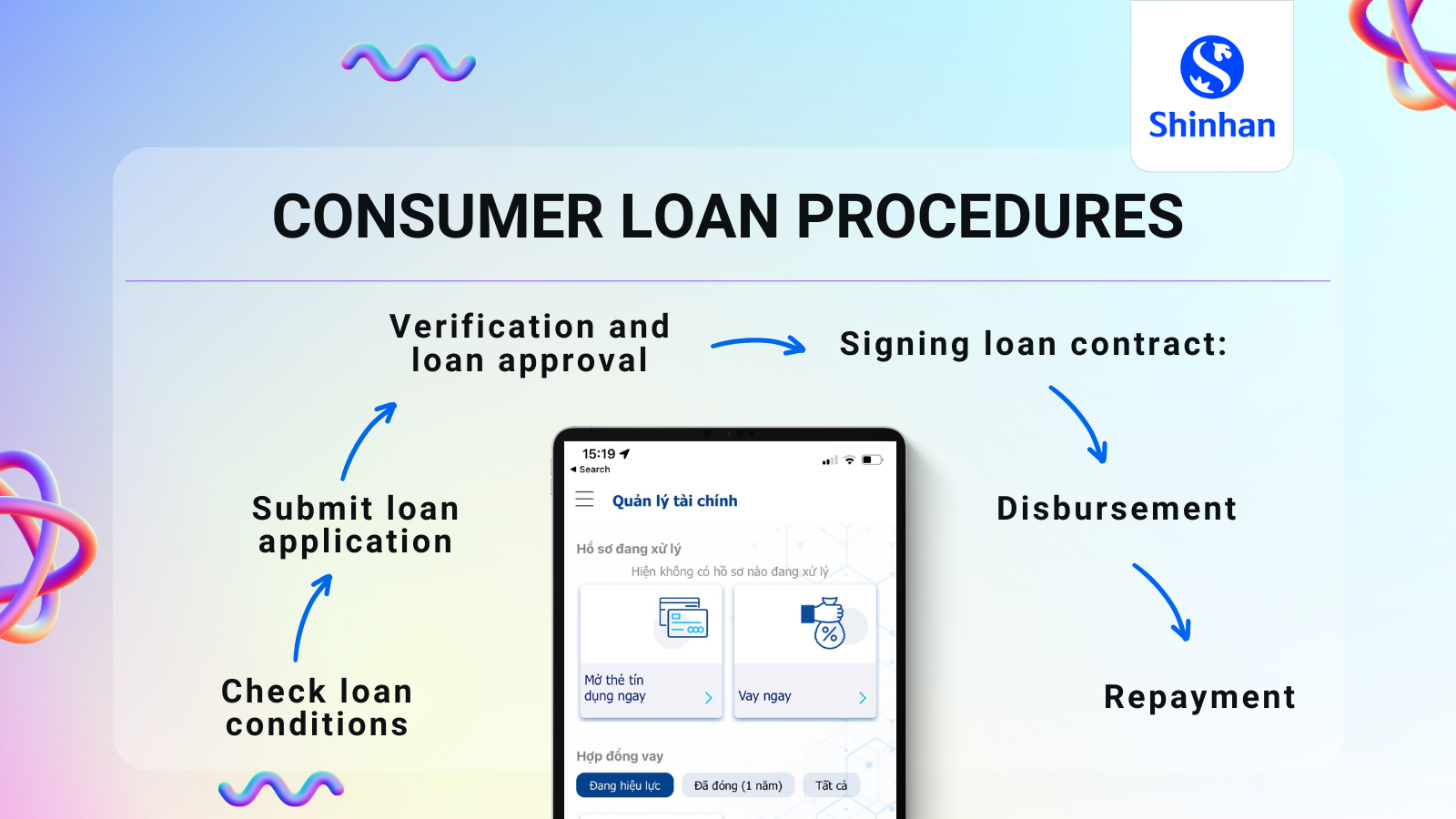

Consumer loan procedures

Depend on the specific bank or financial institution, there may be different steps and procedures, but generally, when applying for a consumer loan, you will go through the following steps:

Check loan conditions: First, you need to check if you meet the loan conditions set by the bank or financial institution. These conditions usually relate to age, monthly income, type of employment, social insurance, and credit history.

Submit loan application: After confirming that you meet the loan conditions, the next step is to prepare and submit the loan application. The application typically included: ID card or passport, proof of income (payroll, labor contract, appointment decision, or other relevant documents), utility bills reflecting your residential address.

Verification and loan approval: The bank or financial institution will verify the information and assess your ability to repay based on the submitted documents. This process may include checking credit history, income, and current debts.

Signing loan contract: If approved, you will be invited to sign a loan agreement. This contract will detail the terms and conditions of the loan, including interest rates, loan terms, loan amount, and payment schedule.

Disbursement: Once the loan agreement is signed, the loan amount will be disbursed to your account or transferred directly for the purpose you applied for.

Repayment: You begin repaying the loan according to the agreed schedule, including both principal and interest.

Note that the specific process and requirements may vary depending on the policies of each bank or financial institution.

Where to get quick consumer loans with low interest rates?

Instead of borrowing from unlicensed credit companies, when you need to borrow consumer loans quickly at low interest rates, the best option is to access reputable banks or financial companies with flexible loan policies and competitive interest rates. Here are some suggestions for you to make the best choice:

- Reputable banks known for offering consumer loan packages with preferential interest rates, although the approval rate may be strict.

- Financial companies offering consumer loan packages with simple procedures, fast disbursement, and competitive interest rates like Shinhan Finance.

When choosing a loan source, you should consider the following factors:

- Regarding interest rates, make sure to carefully study the actual interest rates applied to the loan, including both fixed and floating rates.

- Procedures and disbursement: Always prioritize loan sources with simple procedures and quick disbursement times.

- Loan conditions: Make sure you meet the loan conditions set by the bank or financial company.

- Reputation of the bank/financial company: Choose a bank or financial company with a good reputation and high customer ratings to ensure safety and transparency.

Don't forget to read the contract carefully and understand all terms before agreeing to the loan to avoid any misunderstandings or unexpected surprises later.

How to get consumer loans at Shinhan Finance?

As a leading financial institution nationwide, Shinhan Finance is a trusted choice for many people. If you're wondering how to get consumer loans at Shinhan Finance, here are some suggestions for you:

You can visit Shinhan Finance branches nationwide for quick advice and loan procedures. Refer to the regulations to apply for personal loans at Shinhan Finance.

To simplify procedures, save time, and reduce travel costs, you can use the iShinhan app. The app was honored to be in the "Top 10 Vietnam Consumer Loans - Digital Financial Sector, Digital Technology Products, Education in 2022". Not only does it provide personal loan services, but it also ensures that all information and notifications related to the loan process are clear and transparent.