Low-Interest Credit Loans: A Comprehensive Guide from Shinhan Finance

Nowadays, "credit loans" has become a flexible solution for individuals and businesses to quickly address their financial needs. From business ventures, car purchases, home repairs, and more, low-interest credit loans open doors for everyone to change their lives and enhance convenience.

So, what exactly are low-interest credit loans, and what are their benefits or risks? Shinhan Finance provides an insightful look into credit loans, helping you understand the benefits, risks, and how to borrow effectively.

Follow this article from Shinhan Finance for more details!

Understanding Credit Loans

Credit loans, a form of capital provided by banks and financial institutions, are an important financial solution for individuals and businesses. They allow borrowing money to meet diverse needs, from consumer spending to business development. The interest rates of credit loans, regulated by the state, ensure fairness and transparency for both borrowers and lenders.

Popular Types of Credit Loans

- Unsecured Loans: This type of credit loan does not require the borrower to provide any collateral. The lending decision is based on financial reputation, credit history, income, and repayment capacity. Unsecured loans are often used for consumer purposes, education, travel, or medical expenses. The interest rate for unsecured loans usually depends on the "beauty" of the credit profile.

- Installment Loans: This form of loan requires customers to repay the principal and interest periodically over the agreed time. This method not only reduces financial burden but also provides comfort for customers choosing flexible and convenient installment loans.

- Consumer Loans: For individuals borrowing to purchase goods and services such as cars, home appliances, electronics, travel, tuition fees, and other consumer needs. Consumer loans can be either unsecured or secured, depending on the lender's conditions.

Benefits of Credit Loans

Credit loans offer financial flexibility, convenient shopping, and enhanced financial capacity. This flexibility and convenience not only meet urgent needs but also improve life quality and financial reputation for borrowers.

Key Points to Consider for Credit Loans

To choose the right loan and use it effectively, you should carefully consider the following:

• Identify the need for the loan: Ask yourself if you really need this loan to avoid unnecessary borrowing.

• Compare various loan packages: Compare loans from different providers, including the lender's reputation, interest rates, repayment terms, payment methods, etc.

• Evaluate repayment capability: Assess your financial condition to choose a suitable loan package without difficulty in repayment; also estimate spending and saving plans to repay on schedule.

When used responsibly, credit loans are a powerful financial tool to address your needs. Shinhan Finance hopes this article gives you a comprehensive understanding of low-interest credit loans and how to borrow smartly and suitably.

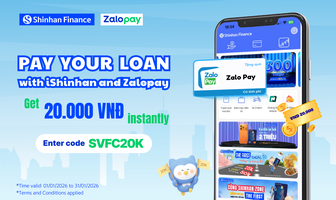

The fastest channels to register for a loan:

- Hotline: 1900 54 54 49 (press 2 – Loan consultation)

- Website Shinhan Finance

- iShinhan financial management application

- Fanpage Shinhan Finance

- Directly at Shinhan Finance transaction counters: See the address details of Shinhan Finance branches.

Sincerely,

Shinhan Finance