Shinhan Finance is launching an Auto loan new financial solution with Hybrid interest rate

From May 24, 2024, our valued customers have an opportunity to choose and experience a financial solution package with a hybrid interest rate in addition to the fixed interest rate when applying for an auto loan at Shinhan Finance.

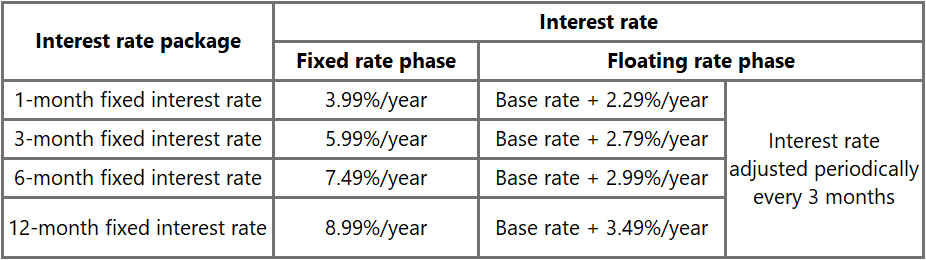

The hybrid interest rate loan consists of two phases: Fixed interest rate phase and Floating interest rate phase. Specifically:

- Fixed interest rate phase: From disbursed loan until a predetermined period (as chosen by customer), the interest rate remains fixed.

- Floating Rate Phase: From fixed interest rate phase ending till the loan is fully repaid, the interest rate is periodically adjusted based on the formula: Floating rate = Base rate + Margin (%).

Shinhan Finance’s hybrid interest rate loans:

Details:

- The base interest rate and margin will be adjusted periodically and announced on Shinhan Finance website.

- The current base interest rate is 9.62%/ year.

- Applicable to a minimum loan tenure of 48 months.

With these two preferential loan packages, customers can save a significant amount of expenses to strengthen their financial issues during the initial borrowing period for the car. Furthermore, Shinhan Finance ensure a professionalism, quick and transparency in our consulting, appraisal and customer care services.

The opportunity to own your dream car has never been easier with Shinhan Finance's hybrid interest rate loan package!

Shinhan Finance