Key Considerations When Signing Loan Agreements at Financial Companies

Legal Status of the Financial Company

According to the Law on Credit Institutions 2010 (amended and supplemented in 2017), only financial institutions with a license from the State Bank of Vietnam are authorized to provide loan services. Therefore, before signing an agreement, borrowers should check the company’s business license and verify whether the organization is legally registered.

If a financial company does not have a license or has unclear legal status, borrowers may face risks of exorbitant interest rates or non-transparent contracts. Choosing a reputable financial company like Shinhan Finance will help minimize legal risks and ensure transparency throughout the loan process. Shinhan Finance, with its operating license granted by the State Bank of Vietnam, strictly adheres to regulations regarding finance and interest rates, ensuring optimal protection for customers. Borrowers can feel assured about fair interest rates and clear contract terms when choosing Shinhan Finance, avoiding risks from unlicensed credit organizations.

Interest Rates and Interest Calculation

According to Circular 43/2016/TT-NHNN on consumer lending by financial companies, loan interest rates must comply with the regulations of the State Bank and not exceed the legal interest ceiling.

When reviewing the loan agreement, borrowers should confirm that the interest rate is clearly stated and easily understood. Financial companies are not allowed to apply an interest rate exceeding 20% per year unless otherwise agreed, but even then, it must not exceed the maximum rate as stipulated by law.

To ensure a clear understanding of payment obligations, borrowers need to fully grasp how interest is calculated to know exactly what they owe before signing the agreement. Currently, financial companies commonly apply two popular methods of interest calculation:

- Interest on Outstanding Loan Balance:

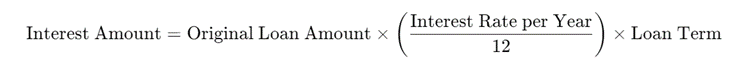

- Interest on Original Principal: The interest rate is calculated on the original loan amount (principal) and remains fixed throughout the loan term, regardless of partial repayments. The interest is calculated as follows:

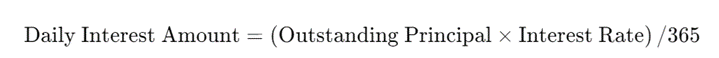

- Interest for each repayment period is determined by:

- The total interest for each payment period equals the sum of daily interest amounts over the period.

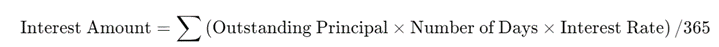

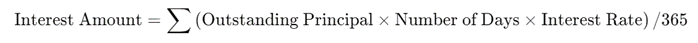

- For credit balances maintained over multiple days in the interest calculation period, a simplified formula is used:

Example: If you borrow 100 million VND at an interest rate of 12% per year for three years, you will have to pay 12 million VND in interest each year, totaling 36 million VND after three years, excluding the principal repayment.

- Interest on Declining Loan Balance: The interest rate is calculated based on the remaining loan balance after each partial repayment of the principal. As a result, the interest amount will decrease with each repayment period. This method is calculated as follows:

- On-time Interest on Principal: Interest rate as per the agreement.

- Overdue Principal Interest: Agreed interest rate multiplied by 150%.

- Late Payment Interest: 10%.

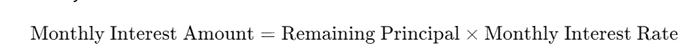

- Monthly Interest Calculation:

- Interest for each repayment period is determined by:

Example: If you borrow 100 million VND at an interest rate of 12% per year, each month you pay off part of the principal, and as a result, the interest amount decreases each month as the principal balance reduces.

Clarify Fees and Related Costs

According to Circular 39/2016/TT-NHNN (amended and supplemented), all fees related to loans, such as consulting fees, service fees, and penalty fees, must be explicitly stated in the contract. Financial companies are prohibited from charging any fees not clearly mentioned in the agreement.

Borrowers should ensure that all arising fees, including early repayment penalties, processing fees, and loan management fees, are clearly explained and detailed in the contract by the financial company. Additionally, borrowers should verify other fees like loan insurance (if applicable) and determine whether it is mandatory or voluntary.

For loans not yet due, borrowers wanting to repay early should be aware of the early repayment fee. According to Circular 39/2016/TT-NHNN, financial companies may apply early repayment fees, but the rate must comply with the contract and not exceed a certain percentage (typically ranging from 1% to 5% of the early payment amount). Borrowers should carefully consider the conditions for early repayment, especially if they plan to pay off the loan early.

Conditions and Payment Schedules

All agreements regarding repayment terms and schedules must be clearly stated in the loan contract (as stipulated in Article 91 of the Law on Credit Institutions 2010). Financial companies are not allowed to arbitrarily change the repayment schedule without customer consent.

The best course of action is for borrowers to request that the financial company provide repayment information, including timelines, payment methods, and the process for dealing with issues during repayment.

Risk Considerations and Dispute Resolution

Borrowers need to be aware of their rights and responsibilities in the event of disputes. Make sure to read carefully and ensure that the contract has clear provisions regarding the resolution of disputes if conflicts arise between the borrower and the financial company.

Moreover, many loan agreements may include disadvantageous clauses that you might overlook, such as those allowing the financial company to adjust interest rates or payment conditions without prior notice. In such cases, borrowers should clarify the terms concerning contract amendments.

Clarify Contract Amendment Terms

Financial companies are not allowed to modify any terms of the contract without the customer’s consent, unless there is an agreed provision explicitly stated in the contract (in accordance with the Civil Code and the Law on Credit Institutions). Therefore, before signing, borrowers should verify whether the contract contains clauses that allow the financial company to change terms such as interest rates or repayment periods. If such clauses exist, it is important to understand your rights regarding these potential changes.

When signing a loan agreement at financial companies, borrowers need to pay particular attention to important elements such as interest rate terms, penalty fees, repayment periods, and their financial capacity. Carefully reading and understanding each term in the contract will help you avoid unnecessary risks and protect your interests. Moreover, always consider carefully before deciding to take a loan, and do not hesitate to ask your advisor if you have any questions.

Wishing you success in your borrowing journey and achieving your financial goals safely and effectively!