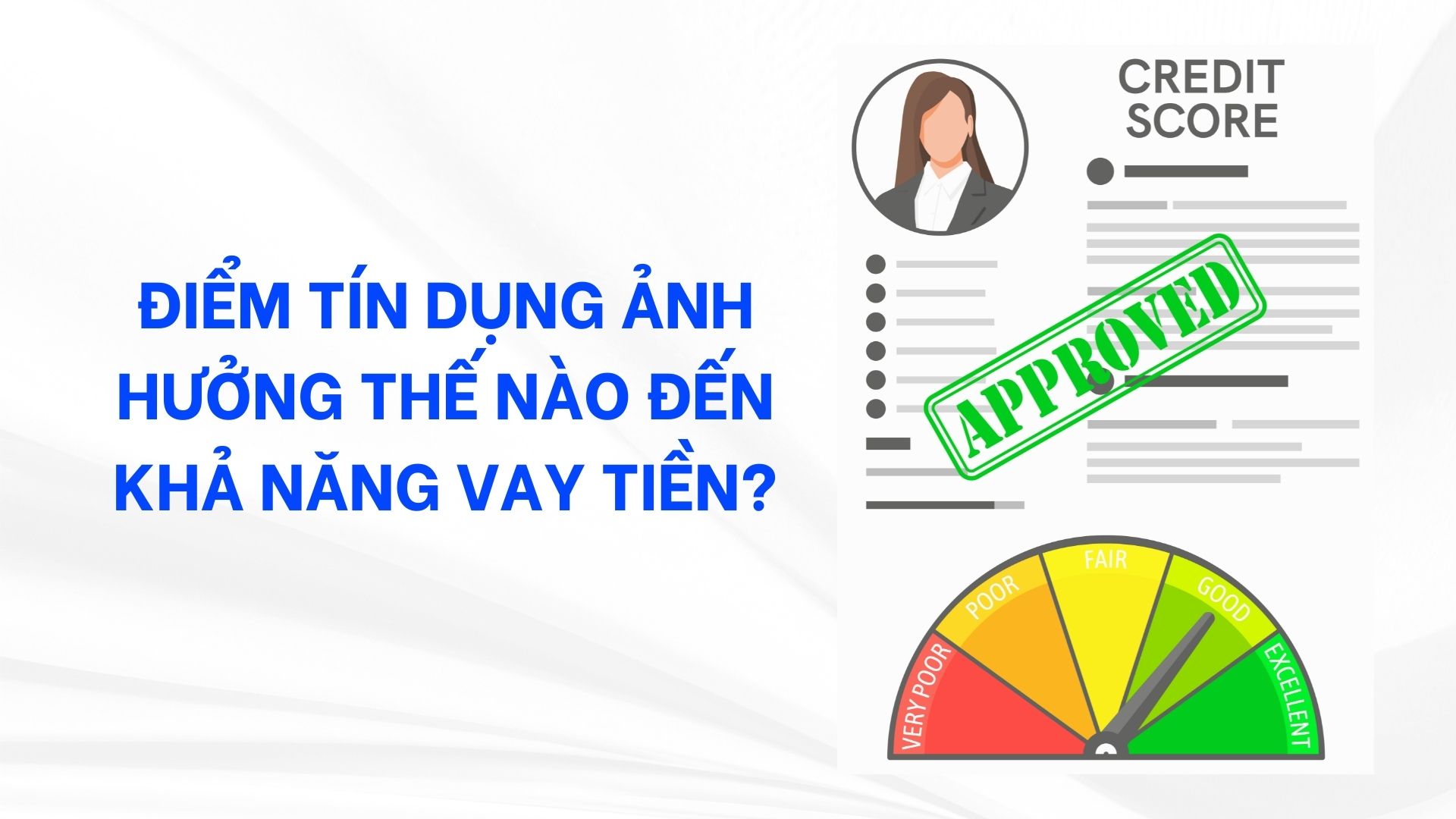

How Credit Scores Impact Your Borrowing Capacity?

In today’s world, borrowing from financial institutions has become increasingly popular among consumers. However, not everyone qualifies easily, and a key determinant in the approval process is one’s credit score. So, what exactly is a credit score, and how does it influence your ability to borrow? This article provides a comprehensive look into credit scores and tips on improving them to enhance your borrowing capacity.

What is a CIC Credit Score?

Definition

The Credit Information Center (CIC) is Vietnam’s national credit information bureau, governed by the State Bank of Vietnam. Its primary function is to collect, store, analyze, and forecast credit information on individuals and organizations across Vietnam. By doing so, CIC aids credit institutions in minimizing lending risks and managing credit effectively.

A CIC credit score reflects an individual’s creditworthiness based on their credit history. Financial institutions like banks and finance companies use this score to assess your repayment capability when you apply for credit. Essentially, it serves as a "personal financial report," indicating whether you’re a trustworthy borrower. But what factors influence the quality of this "personal financial report"?

Factors Affecting Your Credit Score

- Payment History: Consistent on-time payments boost your credit score significantly. This is considered the most crucial factor.

- Total Debt Amount: High levels of debt relative to income suggest higher risk to lenders, impacting your score negatively. Using more than 30% of your available credit limit may harm your score.

- Credit Account Tenure: A longer credit history provides lenders with a better basis for assessing your stability.

- New Credit Accounts: Opening multiple accounts within a short time can negatively impact your score, as it may suggest a reliance on borrowing.

Credit Score Ranges

Credit scores are typically rated on a scale from 150 to 750:

- 150 - 321: Low score; high-risk borrowers with low chances of loan approval (delinquent over 360 days).

- 322 - 430: Fairly low score; high-risk borrowers (delinquent 180 - 360 days), typically not eligible for loans.

- 432 - 569: Average score; usually associated with relatively high-interest rates (delinquent 90 - 180 days).

- 570 - 679: Low risk; eligible for loans, likely approved at favorable rates.

- 680 - 750: Very low risk; ideal borrowers eligible for loans at low rates and high loan limits.

How to Check Your Credit Score?

You can easily check your credit score through the CIC’s online portal by following these steps:

- Visit the official CIC website: https://cic.gov.vn

- Register an account by selecting “Sign Up” at the top right corner.

- Fill in the required information, including full name, birth date, phone number, address, and ID card images.

- After submitting your details, you will receive an OTP code on your phone. Enter the code, agree to the terms, and submit.

- Once verified (2-3 days), log in and view your credit score under your personal information.

What is Borrowing Capacity?

Borrowing capacity is the ability of an individual to obtain loans from banks, financial companies, or other lending institutions. While credit score is a critical factor, lenders also consider the following aspects to assess your repayment potential:- Income: Is your monthly income sufficient to cover loan payments and living expenses?

- Credit History: Have you repaid previous loans on time? Are there any unresolved or overdue debts?

- Current Financial Situation: Are you currently servicing other loans? Have you faced recent financial challenges?

With a good credit score, steady income, and a clean credit history, your chances of loan approval are high. Conversely, if these factors are weak, your borrowing capacity decreases, and you may face higher interest rates and stricter loan conditions if approved.

How Credit Scores Impact Borrowing Capacity?

As mentioned, credit scores are pivotal in determining your borrowing capacity. Financial institutions use your score to gauge the risk associated with lending to you, which influences loan approval and interest rates.

Benefits of a High Credit Score

- Easier Loan Approval: With a score of 570 to 750, you are more likely to get approved without hassle.

- Lower Interest Rates: A high score often means lenders view you as low risk and may offer better rates, saving you on repayment costs.

- Favorable Loan Terms: Beyond lower rates, high-score borrowers may access more flexible loan packages, such as longer repayment terms or larger loan amounts.

Risks and Limitations of a Low Credit Score

- Loan Approval Difficulties: Lenders often deny loans to those with low scores due to perceived risk.

- Higher Interest Rates: If approved, low-score borrowers may face high rates as lenders offset their risk.

- Lower Loan Limits: Those with low scores typically receive smaller loan amounts than they may need.

Tips for Improving Your Credit Score

If you have a less-than-ideal credit score, consider the following strategies to improve it:

- Make Timely Payments: Paying your loans on time shows your reliability and improves your score.

- Maintain a Low Debt-to-Credit Ratio: Keep your debt below 30% of your credit limit to demonstrate good financial management.

- Avoid Opening Multiple Accounts Quickly: Excessive new accounts may alarm lenders, as it can suggest financial strain.

- Avoid Co-Signing Loans for Others: Co-signing exposes you to risk if the other party defaults, which could damage your score.

- Monitor Your Credit Score Regularly: Check your credit report periodically to stay informed about your financial health and detect any errors or suspicious transactions early.

Credit scores are a crucial element affecting your borrowing capacity. Maintaining a high score not only helps you access loans more easily but also ensures you get the most favorable rates. By understanding and managing your personal finances well, you can build a solid financial foundation for the future.

We hope the information in this article will assist you in managing your finances effectively.