How to Address a Personal Financial Crisis

In the current economic downturn, many individuals find themselves facing financial crises. Whether due to job loss, unexpected expenses, or accumulated debt, managing a personal financial crisis can be a significant challenge. However, with a clear plan and the right approach, it is entirely possible to overcome these difficulties. This article provides insights into navigating financial distress, from restructuring finances to seeking additional income streams.

Understanding Personal Financial Crisis

Before delving into strategies, let’s define what a personal financial crisis entails. A financial crisis occurs when you are unable to meet your financial obligations. This may result from sudden job loss, costly health issues, or simply overspending beyond your means. Regardless of the cause, the consequences often involve mounting debts and increased financial pressure. Recognizing the signs of a financial crisis early can help you take timely corrective actions.

Key Indicators of a Personal Financial Crisis

If you experience any of the following, it may indicate that you are facing a financial crisis:

- Frequent delays in paying bills or loan installments.

- Reliance on credit cards to cover essential living expenses.

- Consistently borrowing from friends or family to manage cash flow.

- Lack of any emergency savings or reserve funds.

- Feeling anxious or stressed whenever financial matters are discussed.

If you recognize one or more of these symptoms, it is essential to remain calm and take immediate steps to address the situation.

Steps to Overcome a Personal Financial Crisis

1. Assess Your Financial Situation

The first and most critical step is to gain a thorough understanding of your current financial status. Take the time to list all your sources of income, fixed and variable expenses, outstanding debts, and available assets. While confronting large figures may be daunting, gaining clarity will provide you with a foundation to make informed decisions moving forward.

2. Reduce Non-Essential Spending

This is the moment to distinguish between "wants" and "needs." Review your expenses closely and prioritize essential items. Consider eliminating discretionary spending, such as dining out, online shopping, or streaming subscriptions. These sacrifices are temporary measures to regain control over your finances, so do not be overly discouraged.

3. Explore Additional Sources of Income

During a financial crisis, any additional income can be invaluable. Reflect on opportunities to earn extra money, such as selling unneeded items, taking on part-time work, or leveraging your skills as a freelancer. Not only can this alleviate your immediate financial burdens, but it also empowers you to feel proactive in addressing the issue.

4. Utilize Your Emergency Fund

If you have been diligent in building an emergency savings fund, now is the time to use it. The purpose of such a fund is precisely to provide financial relief in times of crisis. However, exercise caution and a clear plan to replenish this fund once the crisis has been resolved.

Targeted Strategies to Navigate Financial Distress

a) The “Snowball” Debt Repayment Method

This strategy focuses on paying off smaller debts first while continuing to make minimum payments on larger obligations. By reducing smaller balances quickly, you can achieve a sense of progress, thereby building momentum to tackle larger debts.

b) Create a “Crisis Budget”

A crisis budget is highly restrictive and only includes essential expenses. Review every cost and ask yourself: “Can I temporarily live without this?” If the answer is yes, consider cutting it out. This approach ensures that your limited resources are allocated efficiently during challenging times.

c) Consider Debt Restructuring

Managing outstanding debts is a top priority during a financial crisis. Debt restructuring—such as negotiating lower interest rates or extending repayment terms—can reduce immediate financial pressures and prevent further debt accumulation.

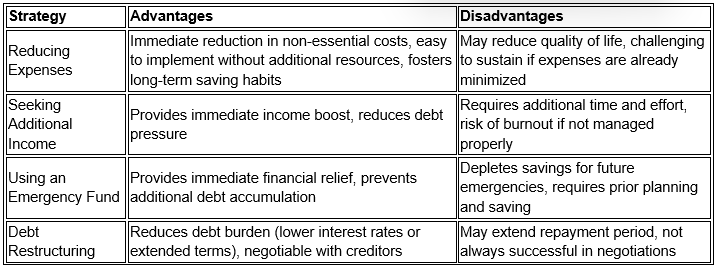

Comparison of Strategies for Overcoming Financial Crises

Common Pitfalls to Avoid During a Financial Crisis

In moments of distress, it’s easy to make decisions that can worsen the situation. Here are some actions to avoid:

- High-interest loans: Taking on short-term loans with exorbitant interest rates can exacerbate your financial challenges.

- Ignoring bills: Delaying payments only compounds debt and negatively impacts your credit score.

- Tapping into retirement savings: This should be a last resort, as it can severely impact your long-term financial security.

- Avoiding the issue: The longer you delay addressing the problem, the worse it becomes. Facing the reality of your financial situation head-on is critical to recovery.

Experiencing a personal financial crisis can be daunting, but it does not signify the end of the road. With patience, discipline, and a strategic approach, it is entirely possible to navigate through this challenge and emerge financially stronger.

“After every storm comes a rainbow”: A financial crisis can serve as an opportunity to reassess spending habits, reset financial goals, and build a more robust financial foundation for the future.

We wish you the best of luck, and we hope this guide proves helpful on your journey toward financial recovery.