Warning of new tricks to scam consumer loans and online investments

Recently, the prolonged pandemic has severely affected manufacturing business which leading to people's lives also being affected, many people fall into difficulties due to job loss, salary reduction, small businesses as well as small businesses stalled. The need to earn money or borrow quickly to cover the temporary life of people increases. Taking advantage of this situation, scammers have used many sophisticated and cunning tricks target people's psychology of needing money immediately to appropriate property through the form of "lending" online via the web or through the application (App).

Especially, the current outstanding trick is the scammers impersonating employees of financial companies, bank employees or introduce themselves as an employee of a company "affiliated" with reputable banking or financial companies. They offer loans with low interest rates, fast approvals, or open small online business investment accounts with huge profits. Customers will be directed to access the website or download the application, or simply connect live chat Zalo with someone claiming to be "credit support staff". Customers must provide personal information, upload photos of identity documents, etc. After that, the customer receives a message informing that an amount has been disbursed to the bank account or e-wallet on fraudulent application, or investment account information has been opened for the purpose of making customers believe that their records are being processed. In cases of tricking into opening an investment account, customers voluntarily pay their investment capital to the App and see their account "balance" increase from a few hundred million to a billion in a very short time, and always ready to withdraw.

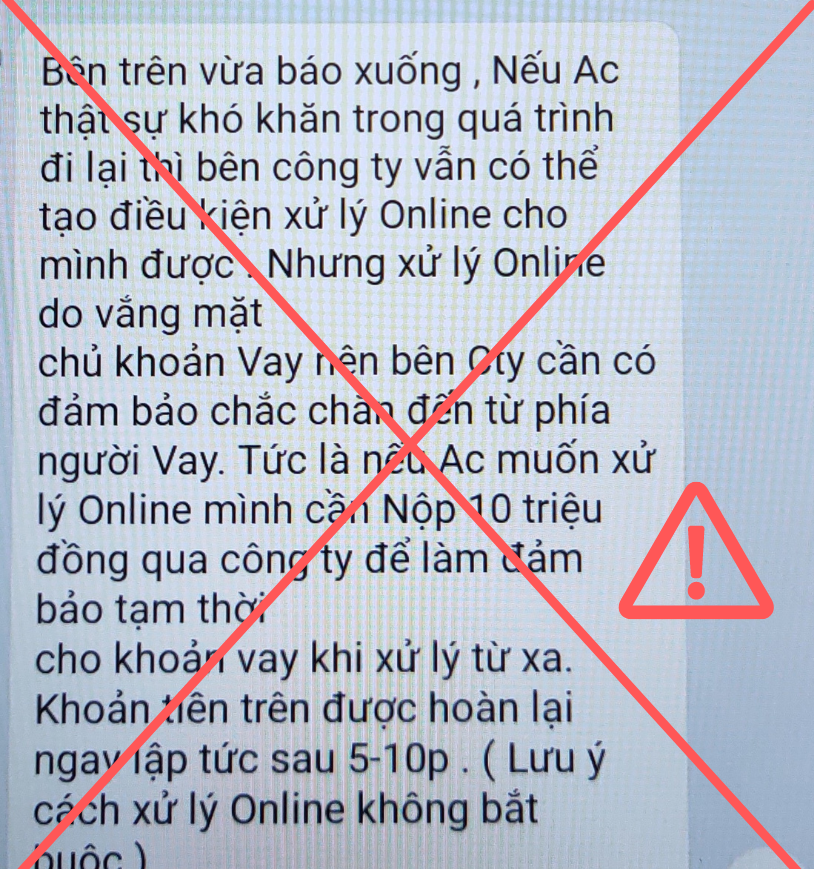

By this time, customers will normally receive the information "loan account/investment account is frozen due to suspicion of counterfeiting", or "incorrect information provided needs to be adjusted in order to withdraw money".

Scammers target the rush to receive money and lack of vigilance to ask customers to pay "account verification fee", “temporary deposit to handle account clearance”, “information adjustment fee”, “suspicious handling fee”, etc. After the first successful appropriation of the property, the scammers will continue to report "unprocessed" or “newly paid fees found to be related to illegal activities” and request additional fees to continue processing customer withdrawals. If the customer does not pay more, all previously paid fees will be forfeited and will not be refunded. With the desire to withdraw the loan or investment money, and regret the previously paid "fee", lots of people have had to borrow from relatives or borrow externally to pay additional fees for the App, up to tens of millions of dong.

Shinhan Finance recommends that customers increase their vigilance and take proactive measures to protect themselves from the risks of being scammed. Early recognition of the signs and appropriate knowledge is considered the best defense today.

- Get aware of the relevant authentic Brand identities and their official social accounts. Most of recognized Brands including Shinhan Finance gets verified by Facebook and Zalo with a checkmark for their official social accounts.

- Those financial companies and banks will never ask you for paying application processing fee, information adjustment fee, deposit or advance to be disbursed. Refer to Shinhan Finance's fee schedule for services after public disbursement here.

- Only submit online loan applications on publicly available websites or applications of reputable financial companies.

- Beware of investment offers or loan offers that having abnormal signs as above. That could be the first sign of a scam.

- If you realize that you are at risk of dealing with scam organizations or scammers, or suspect that you are being approached by scammers, please contact your bank or financial company to verify immediately.

- Always give priority to reporting to the investigative police about any suspected scam or scam, even if you are not the victim of such scams.

Over the past year, Shinhan Finance has introduced a mobile application with the function of online loan application and loan management iShinhan with a digitized loan application process to prevent scam. At the same time, Shinhan Finance also introduced SVFC Bot to help customers find the official and safe source of the Company's loan application.

Shinhan Finance is a consumer finance company with an official and complete information about all products, services and loan processes publicly posted at website: www.shinhanfinance.com.vn.

* For further queries may arise please contact our official channels:

- Hotline 1900 5454 49, or

- Chat to Shinhan Finance Zalo Official Account at bit.ly/ShinhanFinance-Zalo-official, or

- Shinhan Finance Facebook Fanpage at www.facebook.com/shinhanfinance.official.

- Download mobile application iShinhan for loan registration.