So sánh cách vay tiền online qua ứng dụng và qua website

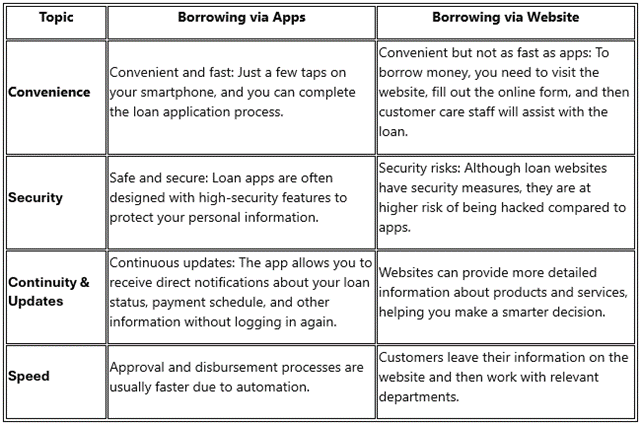

In the digital age, borrowing money has become easier and faster than ever thanks to online loan services. With technological advancements, you no longer need to visit banks or financial institutions directly but can easily borrow money on your smartphone or through a website. But which is the best method or option? Let's analyze the differences between borrowing via apps and via websites.

Which Option Is Better for You?

Depending on your needs, you can consider choosing the best option for yourself. Here are two points to help you decide and consider different loan methods:

- Based on Personal Needs

If you prioritize convenience and speed and often move around, borrowing via apps might be the right choice. Apps are suitable for those who frequently use smartphones and need quick access to financial services.

The iShinhan app from Shinhan Finance is a choice that can meet your loan needs quickly and securely.

Conversely, if you prioritize diversity and transparency of information, want more options to consider, and don't mind taking some extra time to research thoroughly, borrowing via websites could be a better choice.

2. Based on Safety Level

Both forms have certain security measures, but apps may have an edge with built-in security features that are frequently updated.

Ultimately, your decision should be based on factors such as convenience, information needs, and safety levels that make you most comfortable. Consider these factors carefully to make the best decision for your financial and personal situation.

Learn More: How to Get Your Online Loan Application Approved Quickly Without Being Rejected?

------------------------------------

The fastest channels to register for a loan:

- Hotline: 1900 54 54 49 (press 2 – Loan consultation)

- Website Shinhan Finance

- iShinhan financial management application

- Fanpage Shinhan Finance

- Directly at Shinhan Finance transaction counters: See the address details of Shinhan Finance branches.

Sincerely,

Shinhan Finance